Congress Passes 21st Century Cures Act

On December 13, 2016, President Obama signed the 21st Century Cures Act (the “Act”), which Congress had passed with strong bipartisan support. Prior to the Act, if an individual with disabilities under the age of 65 had their own assets and desired to transfer those assets to a supplemental needs payback trust (also known as a “d(4)(A) trust” or an “OBRA trust”) to facilitate eligibility for means-tested public benefits (specifically, SSI or Medicaid), such a trust could be created only by their parent, grandparent, court-appointed guardian, or the court. This limitation meant that, if an individual with disabilities had no living parents or grandparents (or if it was unduly difficult or otherwise problematic to involve their living parents or grandparents in their planning), they could not create a payback trust themselves, but instead had to endure the cost and complexity of court involvement to establish and fund the trust. The Act makes the very welcome change of allowing individuals with disabilities to create their own payback trust.

Might the Act Simplify the Payback Trust Seeding Issue?

In the last couple of years, the Social Security Administration (“SSA”) has started taking the position that establishing a supplemental needs payback trust includes not only executing the relevant trust document, but also actually funding (“seeding”) the trust with a modest amount of assets. For Illinois trusts generally, trust funding has historically been accomplished by including a schedule of property at the end of the trust listing a nominal amount (e.g., “Ten Dollars”). However, the SSA has appeared to require more tangible evidence of seeding than this schedule alone. The clearest evidence of trust seeding would be the establishment of a payback trust account funded with a small amount of the assets of the person executing the trust (the trust “grantor”). Some commentators suggest that seeding also could be accomplished by stapling a $10 bill to the trust document at the time of execution or having the grantor mail a $10 bill to the trustee of the payback trust as a trust deposit and having the trustee keep the $10 and the postmarked envelope as evidence of appropriate trust seeding. In any case, the SSA’s seeding position has created an added administrative burden for those executing (or who in the past executed) payback trusts.

The passage of the Act might undercut the rationale for the SSA’s seeding position. If a payback trust now may be created not only by a parent or grandparent but also by the beneficiary, arguably the execution of the trust document by the parent or grandparent and funding out of the beneficiary’s own assets would be sufficient for valid trust creation. We are hopeful that the SSA will reach that conclusion and cease questioning the validity of payback trusts based on insufficient trust seeding. Until we receive definitive guidance from the SSA, however, it would be prudent for parent or grandparent grantors of payback trusts to fund them with a nominal amount of assets as soon as possible after trust execution (or, for payback trusts that were executed previously but have not yet been funded, as soon as practical now), and, in any case, before the beneficiary’s assets are added.

If you have previously executed a payback trust and have questions about the seeding issue or how it might be affected by the Act, please contact us.

First ABLE Accounts Introduced

In 2016, the first “ABLE” accounts were introduced under the federal Achieving a Better Life Experience Act (the “ABLE Act”). Under this law, individuals with a qualifying disability that commenced before age 26 may benefit from a tax-free savings account for their “qualified disability expenses” without interfering with their eligibility for means-tested public benefits.

Under the ABLE Act, which was patterned after the prior law authorizing 529 college savings plans, each state may enact its own ABLE program. To date, a number of states have already opened ABLE programs for enrollment or are in the process of developing programs. Illinois is currently working on establishing its ABLE program, but some other states with existing ABLE programs permit residents of Illinois (or any other state) to establish an ABLE account through their program. The ABLE National Resource Center provides updates on the implementation of ABLE accounts in different states.

ABLE Accounts are subject to certain restrictions and administrative requirements, and they are likely not a complete substitute for supplemental needs trusts in most cases. However, in many cases, they will be a very useful tool for families.

If you would like to discuss whether you or your loved one might benefit from an ABLE Account, please let us know.

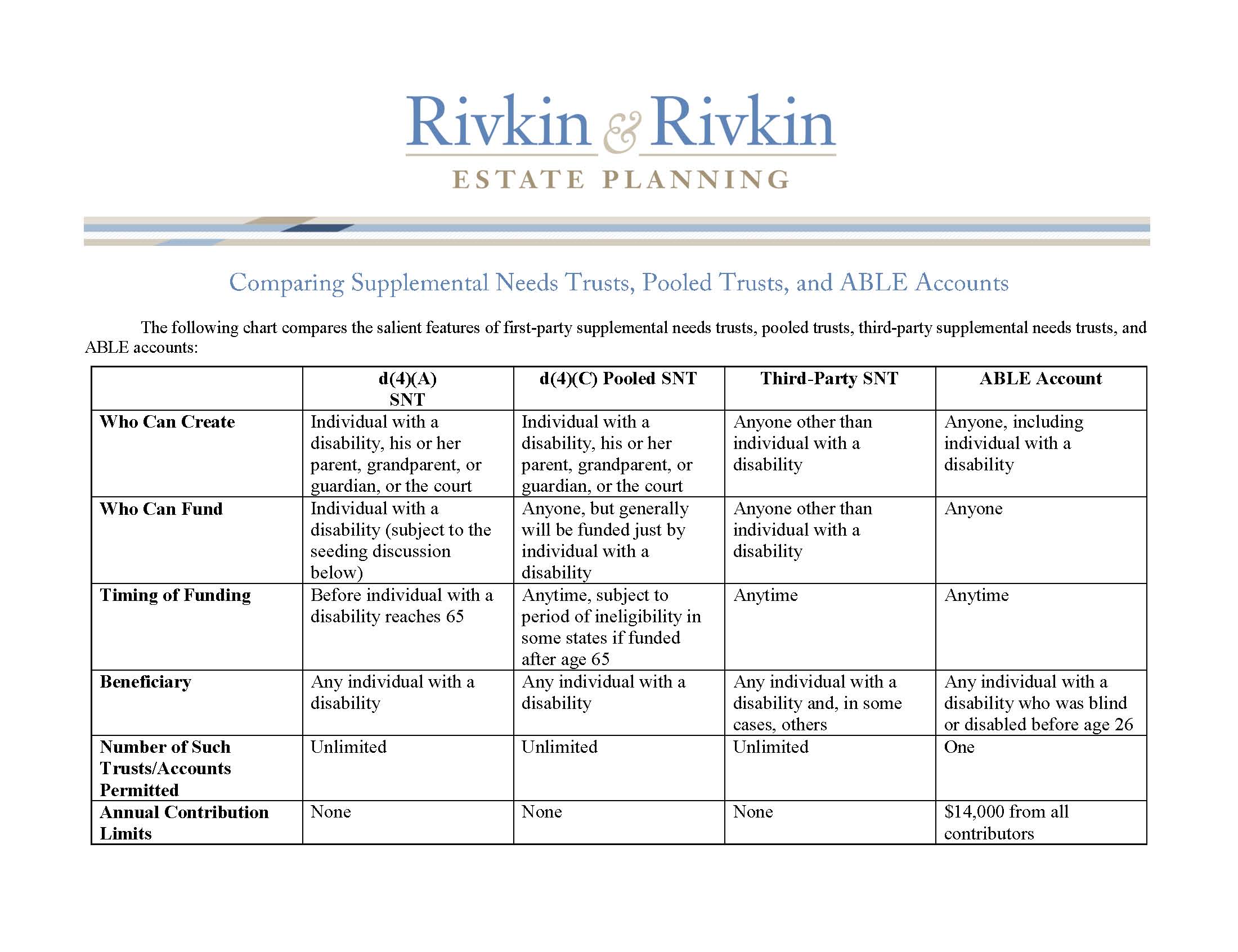

Chart Comparing Trusts and ABLE Accounts

Families Continue to Benefit from Our Pro-Bono Supplemental Needs Planning Program

We are pleased to announce that nearly 60 families of modest means that have children with disabilities have completed estate plans through our Supplemental Needs Planning Program. Since 2014, the program has been entirely pro bono. Our next presentation for prospective program participants is scheduled for January 21, 2017. If you know of any families that might be interested, please refer them to www.rivkinprobono.org for information and to see if they meet the eligibility requirements.

This update has been prepared for general informational purposes only and should not be construed as legal advice on any specific facts or circumstances.

STAY IN THE LOOP

Subscribe to our free newsletter.

For the estate planning community, 2024 feels like the calm before the storm...

As with federal and Illinois tax and trust law, recent law changes related to special needs planning have been modest but important...

A federal court ruling and subsequent appeal have created uncertainty about the constitutionality of the Corporate Transparency Act, the federal statute that came into effect in 2024 with new reporting requirements for privately-held LLCs, corporations, and partnerships. While the appeal proceeds, the clock is ticking for such entities to either comply with the statute’s reporting requirements or potentially face stiff penalties...

This February marked the 25th anniversary of our practice. That milestone fills us with gratitude – for our incredible team, for the outstanding professional advisors with whom we have collaborated, and especially for the caring, thoughtful, and interesting individuals and families who have placed their trust in us...