We work with individuals and couples on a broad array of estate planning issues, from simple wills, living trusts, and powers of attorney to complicated and multi-faceted estate plans.

For those who have never done estate planning, or who did planning many years ago, we invite you to review the following content to help prepare for an estate planning consultation.

Helpful Post-Planning Links

Signing thoughtful estate planning documents is a great start to reducing the time and expense in handling your affairs upon your disability or death. There are several other resources you can consider to facilitate the administration of your estate and the implementation of your wishes.

Prepare for an estate planning consultation

The estate planning process has numerous goals, including, among others, the following:

- Providing financially for a spouse, children, and other loved ones

- Structuring inheritances that provide young beneficiaries with appropriate support and opportunity without diminishing their ambition or otherwise negatively impacting them

- Meeting charitable goals in tax-advantageous ways

- Arranging for the care of minor children and children with special needs

- Memorializing wishes regarding end-of-life care and other medical decisions

- Deferring and minimizing income, estate, and other transfer taxes

- Facilitating simplified and smooth transitions in financial control at death or incapacity

- Planning for family business continuation and the equitable treatment of family members not in the business

- Keeping beloved residences in the family for multiple generations and creating other multigenerational legacies

- Addressing financial issues surrounding second marriages, including protection for the children of a first marriage

- Protecting hard-earned assets from claims of third parties, such as a beneficiary’s spouse in the event of divorce

- Preserving family harmony

We will discuss those goals that are of particular importance to you when we meet.

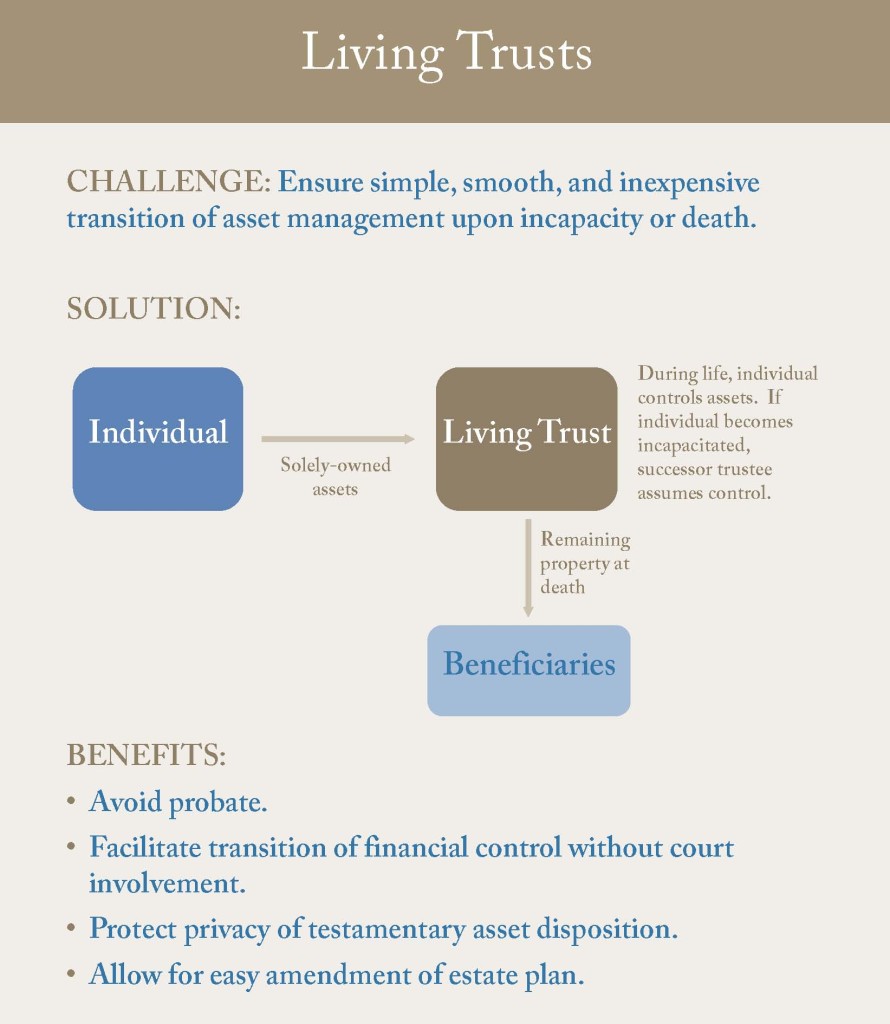

Many people have heard of probate but do not know exactly what it is. Simply put, probate is a procedure that each state has to govern the disposition of assets when someone dies. It is intended to create an orderly legal process at death that protects third parties, such as a hospital, that might have a claim on the decedent’s assets. Although probate often is not as burdensome as many people fear, it takes time (in Illinois, for example, the process takes at least 6 months), makes estate information part of the public record, and results in assorted legal, court, and publication fees.

Many people have heard of probate but do not know exactly what it is. Simply put, probate is a procedure that each state has to govern the disposition of assets when someone dies. It is intended to create an orderly legal process at death that protects third parties, such as a hospital, that might have a claim on the decedent’s assets. Although probate often is not as burdensome as many people fear, it takes time (in Illinois, for example, the process takes at least 6 months), makes estate information part of the public record, and results in assorted legal, court, and publication fees.

The time, public disclosure, and cost of probate often can be avoided with careful attention to how assets are structured. Jointly-owned assets, assets with a designated beneficiary, and assets owned by a living trust all can pass outside of probate at death. As a result, probate can be avoided in some cases simply by using a combination of joint ownership and beneficiary designations (though joint ownership can have unintended consequences and should only be pursued with careful guidance). In other cases, you can avoid probate by titling those assets that do not have a joint owner or beneficiary in the name of a living trust. A living trust is a trust that you control and that can hold assets during your life and after your death.

When we meet, we can discuss whether a living trust would be desirable for you.

For many years, there have been federal gift taxes on transfers during life, estate taxes on transfers at death (including on the value of life insurance proceeds), and generation-skipping transfer (“GST”) taxes on transfers that cross generations. In addition, Illinois and many other states have imposed a separate inheritance tax on transfers at death. The federal gift, estate, and GST tax rate is a fixed 40%, and the top Illinois estate tax rate is effectively 28.57%.

The good news is that there are a variety of tax deductions and exclusions that can be used before paying any transfer tax. During life, anyone can give up to $19,000 per year to anyone they want and can pay tuition or medical expenses for anyone (directly to the provider) without a dollar limitation. In addition, during life or at death, each person can give unlimited amounts to their spouse (if a U.S. citizen) or to charity. Finally, for 2026, in addition to the other federal deductions and exclusions, each person has a $15,000,000 federal exemption for transfers during life or at death, as well as a $15,000,000 federal exemption for GST transfers. The federal exemptions will be indexed for inflation annually. Illinois has no separate gift tax and provides a $4,000,000 exemption against Illinois estate tax for deaths in 2026.

Any unused federal estate tax exemption of the first spouse to die may be transferred to and used by the surviving spouse at death, a concept known as “portability.” To take advantage of portability, the estate of the first spouse to die must file a federal estate tax return. Portability does not apply for federal GST tax purposes or Illinois estate tax purposes.

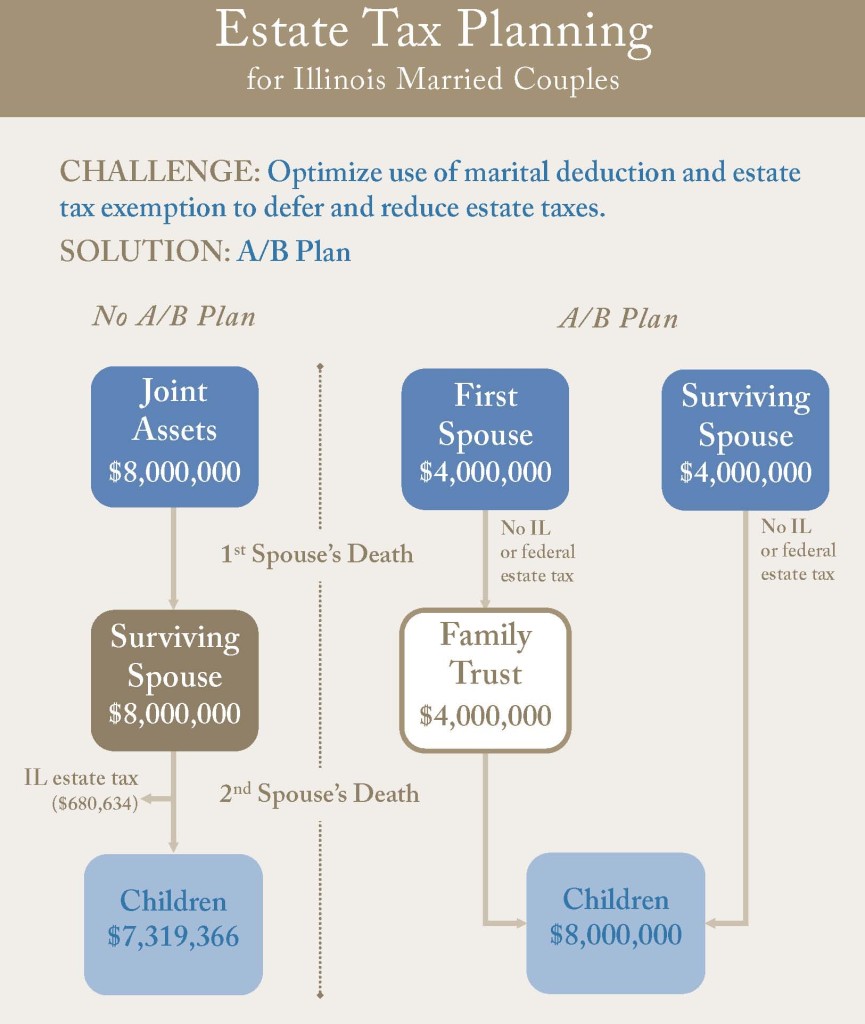

If you are married and your combined assets (including life insurance) exceed $4,000,000, you might benefit from a technique known as an A/B Plan. Under an A/B Plan, at the death of the first of you to die, the lesser of any federal and Illinois exemption amounts would be allocated to a “Family Trust” (also known as a “Credit Shelter Trust”), and the balance of the first-to-die’s property would be allocated to, or in trust for, the surviving spouse. In this way, no federal or state estate tax would be due at the first death, and any federal and state estate tax due at the second death would be reduced.

If you are married and your combined assets (including life insurance) exceed $4,000,000, you might benefit from a technique known as an A/B Plan. Under an A/B Plan, at the death of the first of you to die, the lesser of any federal and Illinois exemption amounts would be allocated to a “Family Trust” (also known as a “Credit Shelter Trust”), and the balance of the first-to-die’s property would be allocated to, or in trust for, the surviving spouse. In this way, no federal or state estate tax would be due at the first death, and any federal and state estate tax due at the second death would be reduced.

Under a concept known as “portability,” any unused federal estate tax exemption of a first spouse to die may be transferred to the surviving spouse by filing a federal estate tax return for the first spouse (see “Estate, Gift, and Generation-Skipping Transfer Taxes” box above). Portability might seem to be a reason to forgo A/B planning and leave all assets directly to the surviving spouse. However, relying on portability likely will increase the cost of administering the first spouse’s estate, while an A/B Plan can: (i) reduce state estate tax at the surviving spouse’s death, (ii) increase the assets that are exempt from generation-skipping transfer taxes, (iii) provide some creditor protection for the surviving spouse, (iv) exempt from estate tax at the surviving spouse’s death the amount by which a portion or all of the first-to-die’s assets appreciated during the survivor’s life, and (v) preserve the estate plan intended by the first to die. Therefore, A/B planning will still be a viable and compelling technique for many married couples.

When we meet, we can discuss whether A/B planning makes sense for you.

Trusts for your spouse, children, or other beneficiaries can provide a number of benefits. They can allow proper management of assets by a trusted family member, friend, or institution for the benefit of children or other beneficiaries that are not equipped to manage assets. In addition, they often can shelter assets from estate or generation-skipping transfer taxes, help protect assets from third-party creditors (such as a spouse of a family member in a divorce), and incorporate your values regarding the use of funds. We can discuss these benefits when we meet.

If you have young children, you should certainly consider leaving assets in trust for them until they reach an appropriate age or set of ages. Before that time, the trustee can be empowered to make distributions for their health, education, or other needs. Upon reaching the designated age(s), the children can be given the right either to withdraw trust assets or become a co-trustee or sole trustee.

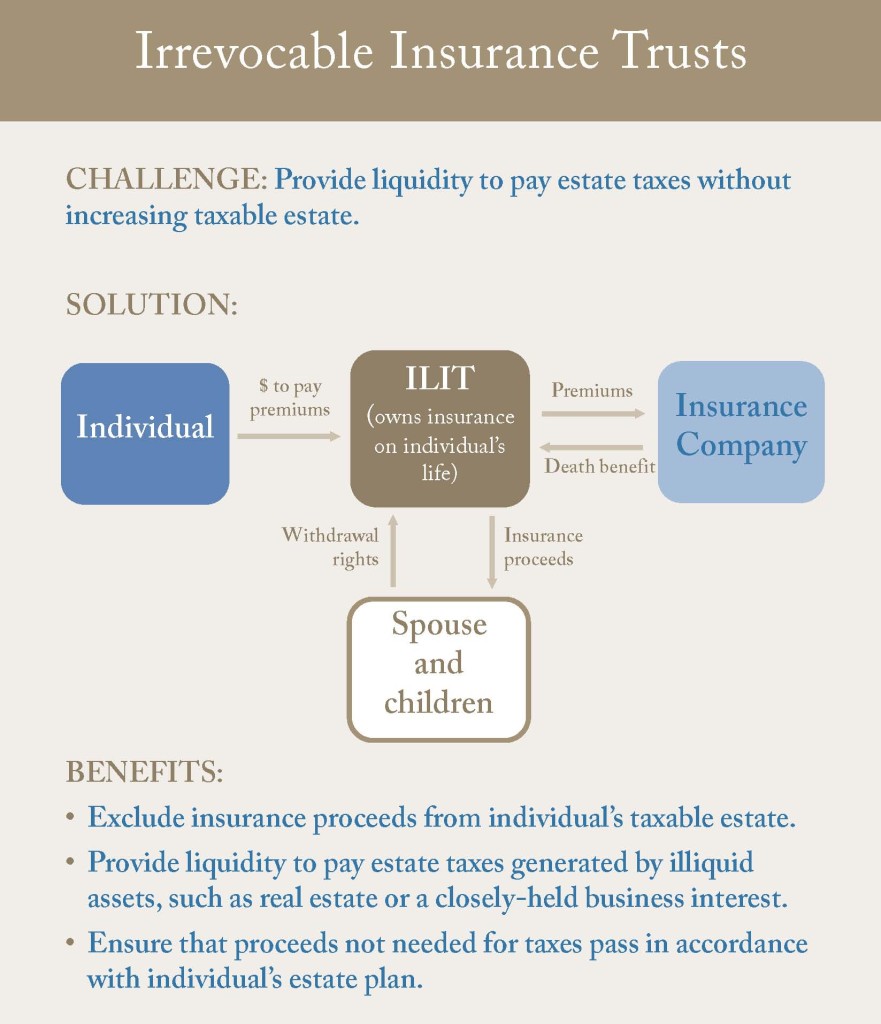

The full face amount of insurance on a person’s life generally is includable in their estate for estate tax purposes unless the insurance was initially obtained by an irrevocable trust or the insurance was transferred to such a trust at least three years before death. This type of trust is often known as an irrevocable life insurance trust or “ILIT.” If you currently have significant life insurance or plan to obtain such insurance, you might want to consider using an ILIT to own that insurance. For the best result, an ILIT generally should be created before a new policy designed to be owned by that ILIT is issued.

The full face amount of insurance on a person’s life generally is includable in their estate for estate tax purposes unless the insurance was initially obtained by an irrevocable trust or the insurance was transferred to such a trust at least three years before death. This type of trust is often known as an irrevocable life insurance trust or “ILIT.” If you currently have significant life insurance or plan to obtain such insurance, you might want to consider using an ILIT to own that insurance. For the best result, an ILIT generally should be created before a new policy designed to be owned by that ILIT is issued.

In addition to improving the world through the financial support of worthy causes, charitable gifts typically qualify for an income tax and either a gift or estate tax charitable deduction. Planned charitable giving does not have to be overly complicated.

For example, four very effective techniques that do not require ongoing attorney or accountant involvement are gifting appreciated assets directly to charity, creating a donor-advised charitable fund with appreciated assets to facilitate annual gifting, establishing a charitable gift annuity with a favorite charity, and funding desired charitable bequests with IRA or qualified retirement plan assets. Planned charitable giving also includes more complicated techniques, such as private foundations, charitable remainder trusts, charitable lead trusts, and charitable gifts of facilities or programs with desired naming rights and use restrictions.

Depending on your charitable goals, we can help tailor a charitable giving plan that is right for you.

Individuals and couples with large estates and a strong desire to minimize estate tax can consider a number of techniques beyond annual exclusion, tuition, and medical gifts. These techniques include, among others, spousal limited access trusts (also known as “SLATs”), qualified personal residence trusts (also known as “QPRTs”), grantor retained annuity trusts (also known as “GRATs”), sales to defective grantor trusts, dynasty trusts, and family limited partnerships or limited liability companies. When we meet, we can discuss whether any of these techniques would be appropriate and desirable for your particular situation.

In order to obtain the maximum benefits of an estate plan from a tax, creditor-protection, and probate-avoidance standpoint, it likely will be advisable for you to change title to certain assets and modify certain beneficiary designations once you have signed your estate planning documents. We will make recommendations for you at that time.

Our process

Step 1.

Click below to complete a short inquiry form.

We will review your information, run a conflict check to confirm there are no conflicts, and then contact you to schedule an initial consultation.

Step 2.

Once we have connected with you (but before your initial consultation), complete our confidential estate planning questionnaire.

Step 3.

Locate any existing wills, trusts, real estate deeds, and other estate planning documents you have previously signed and either send copies to us before (or bring them to) your initial consultation.

Step 4.

To help prepare for your initial consultation, review background information on estate planning.

Step 5.

Begin contemplating the decisions you will need to make as part of the estate planning process.

Decisions

In order to make the most out of your initial consultation, we recommend that you spend a little time prior to the consultation considering some of the primary estate planning decision points.

Often the most difficult aspect of estate planning is choosing your desired guardians, executors, trustees, and agents for your financial and medical affairs. The following describes these various roles, and we can discuss the duties associated with each of them in more detail when we meet:

Health Care Agent

The person who will make health care decisions for you in the event of your incapacity.

Guardians

The person or persons who will care for your minor children or adult disabled children if you are deceased or incapacitated.

Executors, Trustees, and Property Agents

The person, bank or trust company, or combination of the two that will handle your financial affairs in the event of your death or incapacity. Although married couples may have different financial decision-makers, it is often advantageous for them to coordinate those choices.

There are different schools of thought regarding the relationship between guardians and trustees. One school favors naming the same choices for each to simplify trust administration. Another school favors purposely naming different choices for each in order to have checks and balances.

We generally recommend an alternative approach: select your best choices for each role, without consciously trying to make them the same or different.

In addition to determining who will manage your affairs in the event of your death or incapacity, you will, of course, need to determine how you want your assets to be distributed at your death. The following are some of the primary questions for you to answer in determining the distribution of your assets:

- At your death, do you want to make any gifts of cash or other assets “off the top” to any individuals outside of your immediate family or charities?

- If you are married:

- Do you want all of your remaining assets to pass to or for the primary benefit of your spouse, or would you prefer to divide the remaining assets between your spouse and your children?

- Would you prefer that assets pass to your spouse outright (so that your spouse can simply add those assets to their own) or in trust? Leaving them in trust, while adding complexity, might help minimize estate tax at the second death, provide some creditor protection to your spouse, and increase the likelihood that the remaining assets will pass to your children at your spouse’s later death.

- At your spouse’s death do you want to make any gifts of cash or other assets “off the top” to any individuals outside of your immediate family or charities?

- If you have children:

- Would you want a trustee to hold the assets in a single fund for all of your children until the oldest or youngest reaches a certain age or instead to immediately divide those assets into separate shares for your children?

- When assets are divided among separate shares for your children, would you want those shares to be equal or in some other proportion?

- Have your children reached an age at which you would want them to receive their inheritance outright or would you prefer that their inheritance be retained in trust?

- At what age or ages would you want your children to gain control of their inheritance either by having withdrawal rights or becoming their own trustee? When we meet, we can discuss the relative advantages and disadvantages of granting each of your children withdrawal rights versus allowing them to become their own trustee.

Even though it might be intended that your property ultimately will pass to your spouse or descendants (if you are married and/or have children), you should determine whom you wish to name as contingent beneficiaries. Contingent beneficiaries are those individuals or charities that will receive any remaining trust property if, at some point in the future, you are not alive and you have no living spouse or descendants. Some common choices are as follows:

- Assets divided among a list of individuals and/or charities, either equally or with different percentages among them.

- Assets divided among family members (or, for married couples, with one-half going to each side’s family), and then further divided between parents, siblings, and/or nieces and nephews.